The rise of BNPL in Saudi

Good afternoon,

Buy now pay later as a concept has existed in the region in different forms for centuries, but its modern form, for which it's known today, arrived in the Middle East just five years ago.

A short-term financing solution with zero interest for consumers, funded by BNPL platforms and covered by merchants through transaction fees, allowing consumers to make purchases and pay over time.

In a very short time, BNPL has grown to become arguably the biggest fintech opportunity in the GCC region.

The two leading players in the space reached valuations of over a billion dollars towards the end of last year and continue to grow at a rapid pace.

This exponential growth of BNPL is mainly driven by Saudi Arabia, which over the next few years could develop into a billion-dollar revenue pool on its own.

In this issue of Termsheet, I break down the rise of BNPL in Saudi Arabia with the help of a few charts.

Let’s get straight into it.

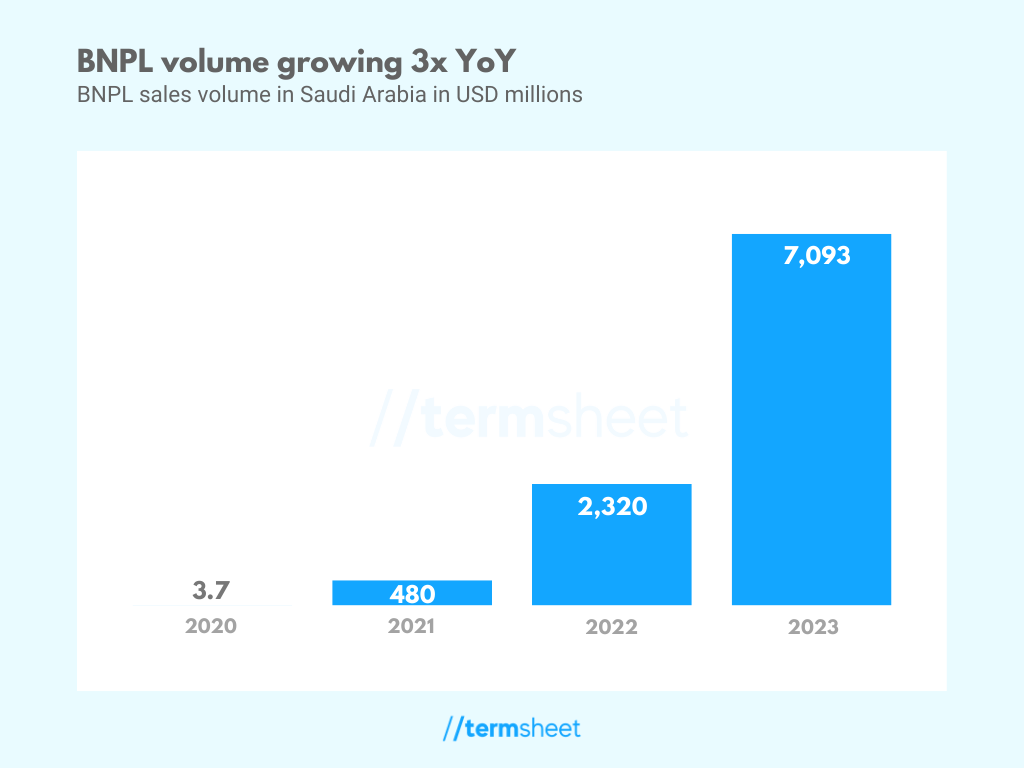

Starting with the volumes.

Starting from almost nothing in 2020, the buy now pay later GMV in Saudi Arabia reached almost $7.1 billion in 2023.

Growing almost 5x in 2022 and more than 3x in 2023.

The numbers for 2024 won't be out anytime soon, but if we take Tabby's peak Ramadan sales as an indication, we're likely to see three-fold growth this year as well.

(Tabby had put up a dashboard with live numbers for March 28, 2024, which was their busiest day of the year, with a GMV of over $43 million across all their markets, up 195 percent increase year over year).

The most interesting aspect here is that the number of active BNPL shoppers actually declined, dropping from 5.8 million in 2022 to 5.7 million in 2023, as shown in the charts below. (The registered users increased from 10 million in 2022 to 13.2 million).

The number of BNPL transactions, during this time, however, nearly tripled, growing from 15.6 million to 43.3 million, which hints significant increase in transaction frequency among the existing customer base.

******

In this second chart, I take a look at BNPL and Mada ecommerce volumes and compare their growth.