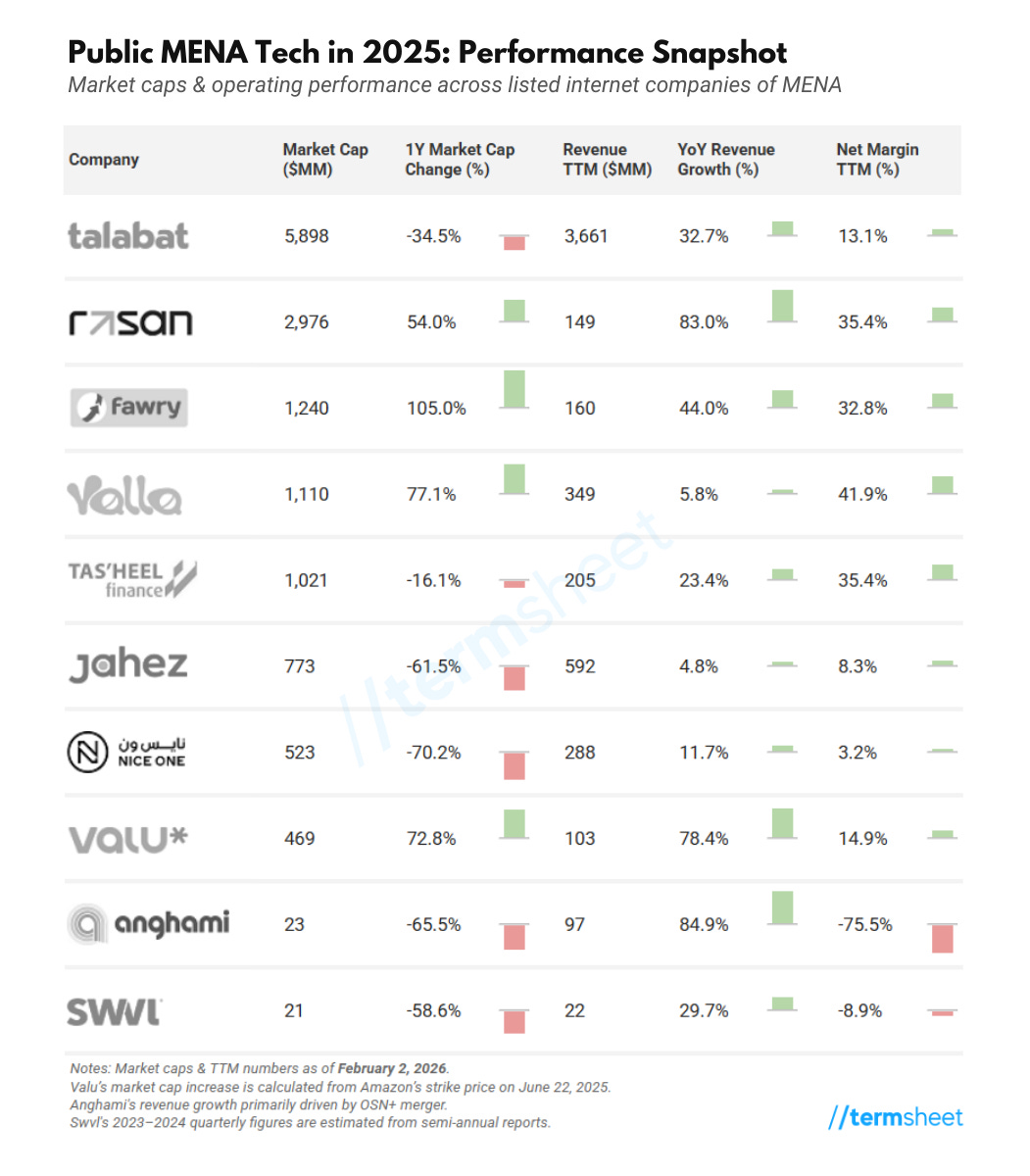

2025: MENA Public Tech, by the Numbers

A quick review of 2025 performance across publicly listed MENA tech companies

Public MENA tech split cleanly in 2025: fintech scaled profitably while nearly everything else struggled.

Here’s the breakdown and some thoughts.

(Market caps as of February 2, 2026. Revenue and margins based on trailing twelve months.)

1. Rasan continues to stand out, for the second year in a row. Its market cap is up more than 50 percent year-over-year to nearly $3 billion, less than two years after going public at around a $750 million valuation.

The numbers explain why. Trailing-twelve-month revenue has grown 83 percent to $149 million. In plain English, the company is doubling its business every fourteen months.

And net margins have expanded to over 35 percent, meaning Rasan keeps $35 of every $100 in revenue as profit.

This margin profile, paired with its hypergrowth, makes Rasan a clear regional outlier. More importantly, it places the company in an elite tier of global technology players that successfully balance growth and profitability.

2. Talabat continues to be a strong business with a weak stock.

The company has grown revenue over 30 percent year-over-year while maintaining 13 percent net margins. But the stock is down almost 35 percent over the same period, pushing market cap to around $6 billion.

And it’s about to get harder. Keeta’s expansion into Talabat’s markets will pressure both growth and margins.

3. Fawry has long been an exceptional business, but currency devaluation was a persistent drag.

For years, strong operating performance was offset by the weakening Egyptian pound. With a more stable EGP in 2025, that changed.

Fawry’s fundamentals have finally translated into equity performance. Trailing twelve-month revenue is up over 44 percent, net margins are 33 percent, and the stock is up 105 percent year-over-year. Market cap now sits above $1.2 billion.

4. Jahez is struggling. Keeta’s entry into Saudi Arabia stalled growth (and should compress margins). The stock is down more than 60 percent year-over-year. Market cap is now at $773 million.

The shift is striking. When Rasan went public, Jahez was roughly twice its size. Today, Jahez is about a quarter of Rasan’s market cap.

More striking: Ninja; still private; is valued at nearly double Jahez. Tells you about the disconnect between public and private valuations in the region.

5. Nice One’s growth has slowed, margins have compressed, and investor confidence has faded.

The stock is down over 70 percent year-over-year, with market cap now around $523 million. This is what public markets tend to do quickly when growth decelerates before a company has built a strong profitability buffer.

The pattern is clear. The region’s fintech is winning in public markets. Rasan, Fawry, Valu, and Tas’heel all show strong growth, healthy margins, and rising market caps.

(Tas’heel is down 16 percent year-over-year but is still trading above its IPO price. It went public in December 2024).

Everything else is struggling. Ecommerce, food delivery, and consumer platforms continue to trade down. Even when revenues grow, public investors won’t pay up without clear profitability and defensibility.

Yalla Group is a partial exception; the stock has recovered over the past year; but it’s still down roughly 80 percent from the peak.

More on some of these companies soon.